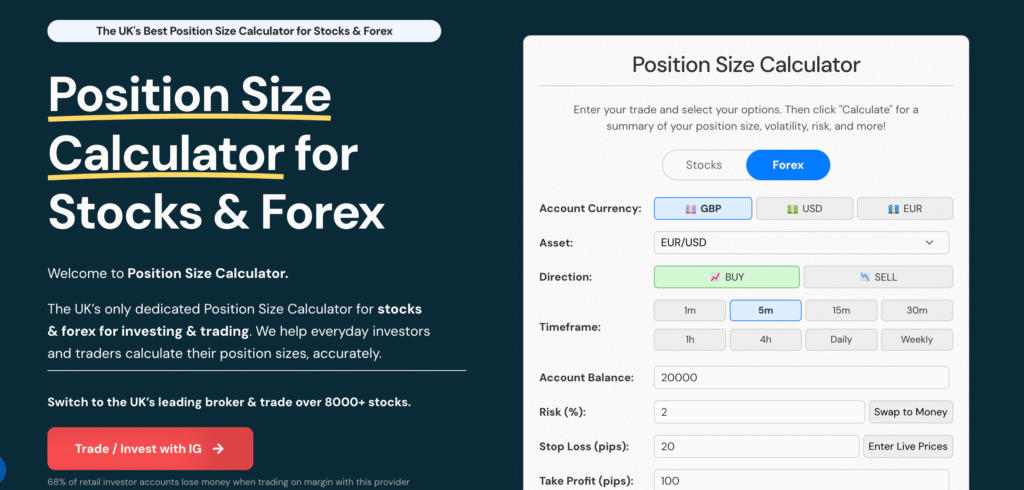

Using a Position Size Calculator

Position size calculators are often overlooked in the world of investing & trading, especially or beginners, but they are perhaps the most useful risk management tool when calculating stock position sizes for trading or investing. We’ve created this step-by-step, beginners guide, to using a Position Size Calculator for both stocks and forex.

In summary, here’s how to use a stock position size calculator:

- Select your account currency.

- Choose between stocks or forex – there are differenced in leverage requirements.

- Choose your trade direction.

- Enter your trading account balance.

- Decide on risk for the trade.

- Enter your entry price, stop loss and take profit.

- Select your timeframe.

- Calculate your position size.

Step-by-Step Guide: Using a Position Size Calculator

Step 1: Select Your Account Currency

Firstly, you need to choose the currency of your trading account. This might be GBP, USD, or EUR, depending on your trading account’s base currency. Choosing the correct currency ensures the calculator accurately reflects the risks in your local currency, particularly when trading assets priced in another currency.

Step 2: Choose Between Stocks or Forex

Our calculator allows you to select between stocks and forex, as the calculation process differs slightly. For stocks, you’ll input the stock ticker (like AAPL for Apple), and for forex, you’ll select a currency pair such as EUR/USD.

Step 3: Choose Your Trade Direction

You must specify if you’re planning to BUY (long) or SELL (short). Selecting the correct direction is crucial, as it determines whether your stop-loss price will be above or below your entry price.

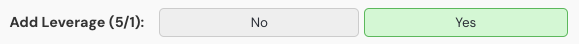

Step 4: Decide on Leverage (Optional)

Leverage allows you to control a larger position size with less capital, but it increases risk. You can select “Yes” or “No” to indicate if you plan to use leverage – this is crucial for differences in trading vs investing. Trading usually uses leverage whereas investing is normally un-leveraged.

The leverage offered by most UK brokers is typically at a standard rate of 5:1 for stocks or higher (20:1) for forex. Using leverage, our calculator will show how your total position value compares to your actual invested capital.

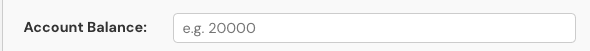

Step 5: Enter Your Trading Account Balance

Next, input your current trading account balance. This is essential because the calculator uses this figure to determine how much capital you can afford to risk on a single trade once you select your risk.

Step 6: Define How Much to Risk

Decide the percentage of your trading account you’re willing to risk on this specific trade. Many traders typically risk between 1-2% per trade. You can enter this as a percentage, and the calculator will automatically convert it into a monetary figure based on your account balance.

Step 7: Input Entry Price and Stop-Loss Levels

Enter your intended entry price (the price at which you will enter the market) and your stop-loss price (the point at which the trade will close automatically if it moves against you). Bear in mind that these entries are often not EXACT as broker spreads will enter you above or below the market price.

Entering a stop-loss ensures you can manage your risk effectively by clearly setting a maximum potential loss. Additionally, you may enter a take profit level, giving you a clearer view of your potential risk-reward scenario.

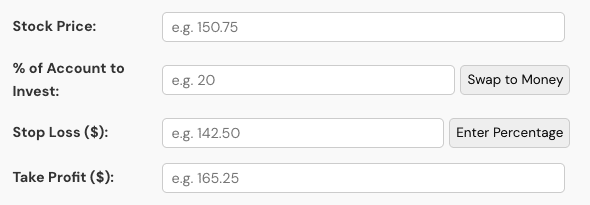

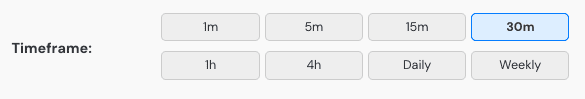

Step 8: Select Your Trading Timeframe (Optional)

Selecting the timeframe for your trade (e.g., 1m, 15m, 1h, daily) provides additional context for your position. Understanding your timeframe helps you visualise your risk more clearly, particularly if you’re executing short-term trades where market movements can be rapid.

Tip: Double-check you are comfortable risking this amount for this timeframe – is £500 on a 5m chart within your tolerance level? Just double-check your comfort / risk level here – don’t rush.

Step 9: Calculate Your Trade

Once all the details are entered, click the “Calculate” button. The calculator instantly provides a clear summary:

- The exact number of shares or forex lots you should trade.

- Total amount at risk in your account currency.

- Estimated fees or spread costs associated with the trade.

- Overall risk rating (Low, Medium, High).

- Potential risk per share or lot.

- Clearly defined Risk-Reward ratio, helping you assess if the potential reward justifies the risk.

What Your Results Show (Example)

For example, suppose you choose to buy AAPL stock at £120 per share with 5:1 leverage, using a £20,000 account and risking 2% (£400):

- The calculator might show you can buy 16 shares.

- Your total amount at risk is clearly shown as £400.

- Your estimated fees/spread might be approximately £1.92.

- Your stop-loss might be at £112 (limiting potential loss), and take profit at £170 (potential gain).

- Your risk-to-reward ratio would be clearly indicated, helping you decide if the trade makes sense based on your strategy.

Alternative Lot Size Calculation: Starting with a Fixed Amount

If you are trading forex and already have a set amount you prefer to risk per trade, enter that directly into the calculator. It will show precisely how many lots you can buy, and clearly highlight your risk in monetary terms. This method simplifies the process, particularly if you typically trade with a fixed monetary risk amount.

Personal Tips for Beginners

- Always double-check all inputs, particularly the entry and stop-loss prices, to avoid errors.

- Regularly update your account balance for accurate position sizing.

- Consistently follow the calculated position sizes to ensure proper risk management.

- Understand leverage carefully—higher leverage significantly increases potential losses as well as profits.

Conclusion

Understanding how to use a Position Size Calculator can dramatically improve your trading outcomes by helping you precisely manage your risk.

Follow these simple steps, and you can confidently determine your ideal position size for both stocks and forex, reducing the likelihood of substantial losses and ensuring your trading remains sustainable in the long run.

James is a full-time UK-based trader for prop firms and using private capital since June 2010. Based in the Edinburgh, Scotland he has been active in the UK finance space for the last 10 years and helps other UK traders and investors calculate lot sizing, position sizing and investing with helpful tools.